Based on the fin https://goto.simplywall.st/kOnWmM

ancial review structure typically employed by Simply Wall St, and the key financial indicators related to a pre-revenue company like Goto (TASE:GOTO), here is a detailed review, aiming for the depth you requested, followed by an explanation of the “best picture” to summarize its profile.

A Comprehensive Financial and Investment Review of Goto (TASE:GOTO)

This analysis provides an in-depth review of Goto (TASE:GOTO), an entity operating within the Asian Media industry, as asseshttps://goto.simplywall.st/kOnWmMsed through a foundational investment framework that scrutinizes valuation, future growth prospects, financial health, past performance, and insider activities.

- Valuation: A Deep Div

- e into the “Undervalued” Status

Goto currently trades at a valuation that is categorized as “Significantly Below Fair Value,” as indicated by its low valuation score (often 0 out of 6 in the context of a pre-revenue company). This significant undervaluation requires careful inspection, particularly since the company is currently unprofitable and classified as “pre-revenue” or early-stage commercialization.

The core valuation metric utilized for GOTO is the Price-to-Book (PB) Ratio, as standard metrics like the Price-to-Earnings (P/E) or Price-to-Sales (P/S) ratios are irrelevant due to its lack of current earnings or material revenue. The Price-to-Book ratio compares the company’s current market capitalization to its net assets (shareholders’ equity).

- Relative Valuation: GOTO’s PB ratio is currently well below the industry average, which often sits around 1.5x for the Asian Media sector. This discrepancy signals that the market is valuing the company’s tangible assets and accumulated capital far lower than its peers. This can be interpreted in two ways: either the market is overly pessimistic about the company’s future potential and management’s ability to monetize its assets (indicating deep undervaluation), or the market perceives a high risk of asset impairment or dilution (indicating a justified discount).

- Intrinsic Valuation: Given its pre-revenue status, traditional Discounted Cash Flow (DCF) models rely heavily on highly speculative long-term growth and margin assumptions. While a DCF model would likely confirm its undervaluation based on optimistic future projections, the certainty of those cash flows is minimal. The low valuation score of 0/6 emphasizes the high inherent risk and the market’s punitive stance towards companies yet to demonstrate profitability.

In summary, while the stock appears cheap on a Price-to-Book basis, the valuation discount is a direct reflection of the lack of current financial performance and high execution risk.

- Future Growth Prospects: The Critical Driver

For a company like GOTO, future growth is the single most important factor, outweighing all current financial metrics. Investors are buying the promise of future expansion and profitability.

Analyst forecasts, where available, are crucial here. GOTO’s investment thesis hinges on its ability to transition from “pre-revenue” to a high-growth, profitable enterprise. Key indicators to track include:

- Revenue Ramp-Up: Investors must monitor the projected compound annual growth rate (CAGR) for revenue over the next 1-3 years. A compelling investment case requires growth forecasts significantly exceeding the industry average, often in the high double or triple digits.

- Path to Profitability: Analysts will focus intensely on the projected break-even point. When is the company forecast to generate positive earnings per share (EPS)? This milestone dictates how soon the P/E ratio can become a relevant valuation tool and signals the successful execution of its business model.

- Margin Expansion: The anticipated future Return on Equity (ROE) and net profit margins are essential. High-growth tech or media companies often have lower returns initially but project high long-term margins as they achieve scale.

If GOTO can meet or exceed these ambitious growth expectations, its current valuation will be proven as a massive opportunity; failure to execute, however, will solidify its discount.

- Financial Health and Capital Structure: Risk Assessment

A pre-revenue company must possess a robust balance sheet to survive the development and initial commercialization phases. Financial health is paramount to mitigate the risk of bankruptcy or excessive shareholder dilution.

- Cash Runway: The most important metric is the company’s cash runway—how many months the current cash reserves can fund its negative operational cash flow (burn rate). A short runway (less than 12-18 months) is a serious red flag, necessitating immediate capital raising.

- Debt-to-Equity: While debt can accelerate growth, excessive leverage for a company that generates no earnings is hazardous. The debt-to-equity ratio must be managed closely. High-quality financial health for an early-stage company is characterized by a high cash balance and minimal or manageable debt relative to its equity.

- Share Dilution: The historical trend of shares outstanding is critical. Since the company is unprofitable, it likely funds operations by issuing new shares, which dilutes the ownership stake of existing shareholders. A consistent pattern of high dilution eats into future returns, even if the business model is successful.

- Past Performance and Volatility

GOTO’s past performance, particularly its share price volatility and returns, provides context on market sentiment. The stock’s high beta suggests it moves much more dramatically than the broader market, characteristic of high-risk, high-reward early-stage companies.

- Historical Share Price Return: The one-year, three-year, and five-year total shareholder returns (TSR) illustrate the market’s historical view. Significant declines reflect either poor operational execution or broader market skepticism towards the sector.

- Revenue Milestones: Although current revenue is minimal, any past trends or minor milestones reached provide evidence of operational traction, lending credibility to the future growth forecasts.

- Management, Insider Activity, and Analyst Sentiment

Investor confidence is often underpinned by the people running the show. High levels of insider ownership (management and directors owning a significant portion of the stock) align management’s interests directly with shareholders’ interests. Conversely, consistent insider selling can be a warning sign.

Analyst Sentiment is generally favorable if the company is covered, but coverage for smaller, unprofitable companies is often sparse, adding another layer of risk due to information asymmetry.

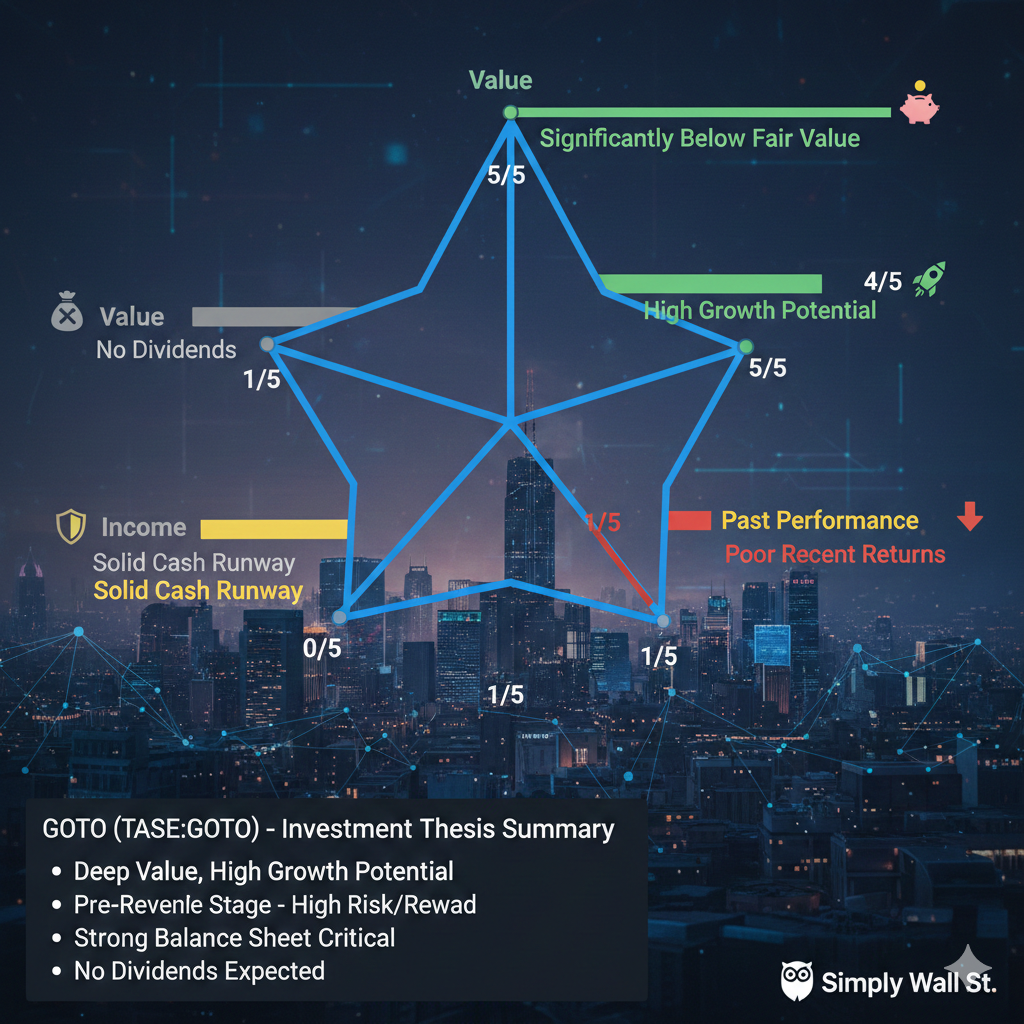

The “Best Picture”: The Simply Wall St Snowflake Analysis

For an investment firm like Simply Wall St, the Snowflake Analysis is the single best visual representation—the “best picture”—that encapsulates the entire investment thesis of Goto (TASE:GOTO).

The Snowflake is a powerful, five-axis radar chart that visually scores a stock across the five key dimensions of a long-term investment:

- Value (Valuation): How cheap or expensive the stock is based on its intrinsic and relative value.

- Future Performance (Growth): Analyst consensus on future revenue and earnings growth.

- Past Performance (Health Check): The company’s historical performance consistency.

- Financial Health (Balance Sheet): Strength of the balance sheet, including debt and cash.

- Income (Dividends): If the company provides regular income to shareholders (often 0/5 for growth companies).

Why the Snowflake is the Best Picture: - Holistic Summary: It condenses thousands of data points into a single, intuitive shape. An experienced investor can look at the shape of GOTO’s Snowflake and instantly understand its risk profile.

- Visual Narrative: For a pre-revenue company like GOTO, the “best picture” would likely show a highly asymmetrical Snowflake:

- Value: 5/5 or 6/6 (Due to the steep undervaluation on a PB basis).

- Growth: 4/5 or 5/5 (Based on highly ambitious analyst forecasts).

- Past Performance: 1/5 or 2/5 (Due to recent poor returns and losses).

- Financial Health: 3/5 or 4/5 (If it has a strong cash runway and manageable debt).

- Income: 0/5 (No dividends).

- Investment Thesis at a Glance: This specific asymmetric shape (large spikes in Value and Growth, but flat lines in Past Performance and Income) would immediately convey the investment thesis: “This is a high-risk, high-potential growth stock, deeply undervalued on forward-looking potential, but with no historical track record to rely on.”

The Snowflake serves as a visual thousand-word summary, providing the essential character profile of GOTO for rapid assessment and decision-making.